It’s never easy for a young founder to step onstage and strut in front of a room filled with seasoned investors. But positive news from the venture capital world probably made Tuesday’s pitch session at Toronto’s Westin Harbour Castle a little less nerve-wracking for the four companies facing a sea of scrutinizing faces.

Communitech’s second Rev Demo Day rode in on the heels of a Canadian Venture Capital Association report citing a record-breaking 2016 first quarter investment of $838 million on 118 deals – almost double the amount invested in Canadian companies in the same quarter last year. Of that total, 58 per cent was raised in Ontario on 47 deals.

“The Toronto-Waterloo corridor is driving the majority of that Ontario investment,” said Janet Bannister, a general partner at Toronto- and Montreal-based Real Ventures and one of the judges at the competition. “When people ask why, I think it’s that we’ve got amazing talent coming out of Waterloo and Toronto universities, great marketing, and that critical mass in the corridor.”

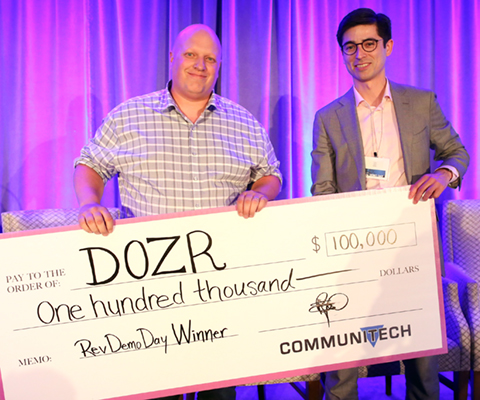

For Kitchener-Waterloo startups like Dozr, CloudWifi, bitHound and Knowledgehook, all of whom took the stage Tuesday afternoon vying for $100,000 in prize money, the CVCA news couldn’t have come at a better time. (Then again, neither could the oversized $100,000 cheque that Dozr co-founder Kevin Forestell took home at the end of the day.)

Kevin Forestell (left), co-founder of Dozr, an equipment sharing

platform for the construction industry, took top honours at

Rev Demo Day. (Photo: Tim Fraser for Communitech)

But according to Matt Leibowitz, a partner at Toronto-based Plaza Ventures, while VC investment totals remain split almost 50/50 between Canadian and U.S. investors, the bigger numbers are still coming from south of the border. So, are Canadian VCs still more risk-averse than their American counterparts?

“I don’t think so. But I don’t think we need to be more risk-taking,” Leibowitz said. “I think we should focus instead on more conservative companies, and on fundamentals and building profitable businesses. And backing those businesses that have those kinds of qualities. Those are the kind of companies that we should be writing $50-, $60-, $80-million dollar cheques to.”

Real Ventures’ Bannister says U.S. investors are definitely refocusing their attention on Canadian companies.

“They’re attracted by two things: first, the U.S. dollar, but more importantly – and more sustainably – is the fact that Canada is being recognized as a place with great companies. And great companies will always get funded. It’s amazing how many U.S. VCs I’ve spoken to in the last six months who say ‘I’ve never made any investments in Canada before,’ who are now coming here.”

For Nicoya Lifesciences CEO Ryan Denomme, who attended the event as one of three Rev alumni, the reality of seeking American venture capital as his nanotechnology company prepares to start raising Series A funding is a fait accompli.

“Our seed funding was raised entirely from Canadian investors,” said Denomme. “And I expect that we would get support from our current investors but I think it would be hard to raise a Series A round just off the local VC population here. We made some great connections in the U.S. during our seed round, so we’ll definitely be reaching out. There’s just bigger cheques and more opportunity.”

Mallorie Brodie and Lauren Lake, co-founders of Waterloo Region construction startup Bridgit, raised their seed capital on both sides of the border.

“Our investment has so far been from Hyde Park, who is from Chicago, and Vanedge, who’s Canadian,” said Brodie, also a Rev alumnus who spoke at a Tuesday panel. Whether future investment comes from the U.S or Canada, fit seems to trump nationality. “For us it’s really important to have a great relationship with our investors. We want to make sure that [any investment] is a good fit for our company and whether there’s alignment there.”

For Canadian VCs like Plaza Ventures’ Matt Leibowitz, news that the Business Development Bank of Canada successfully put $1.35 billion under management through the Venture Capital Action Plan in early April means that the Canadian venture capital landscape is ripe for reinvigoration, however cautiously that might proceed.

“It enables funds like us to put more money to work balancing institutional capital, private capital and corporate capital, so from our perspective it’s very exciting. I hope so. I hope we can do more deals. But again, it’s focusing on fundamentals, focus on metrics, focus on basic business principles.”